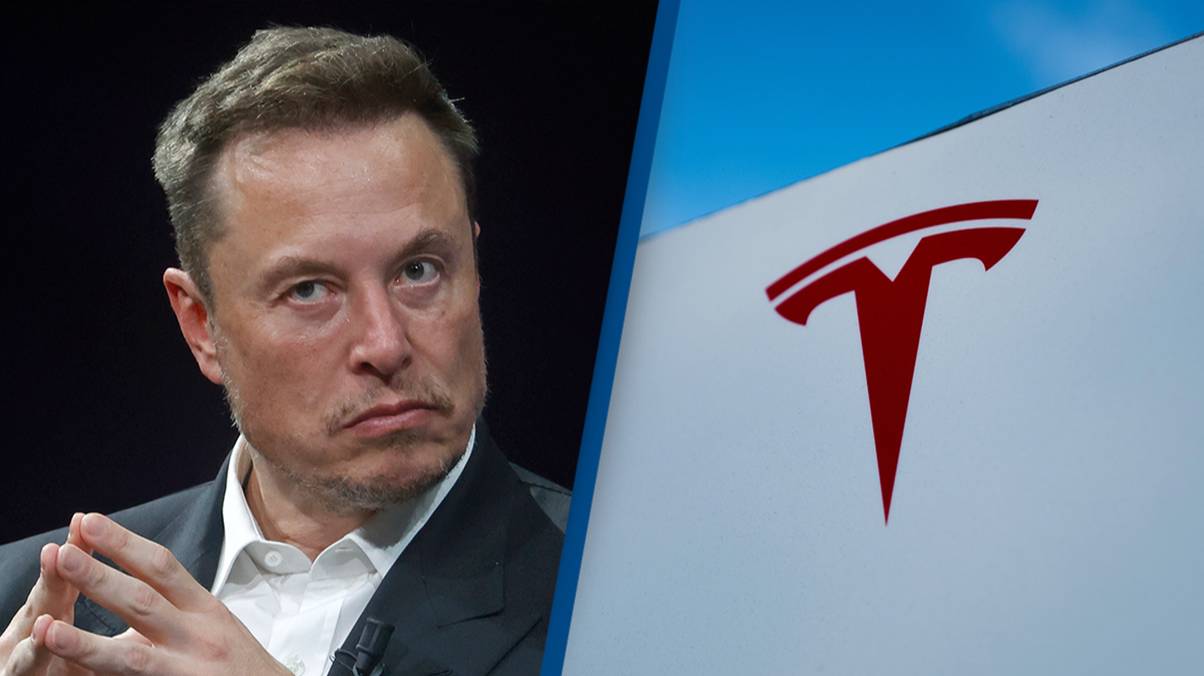

A major Tesla investor has sold its entire stake after CEO Elon Musk attempted to wangle himself a record-breaking pay package.

Entrepreneur Musk is the world’s richest man, with a net worth of more than $400 billion, as per Forbes.

But in 2018, Tesla shareholders initially voted to approve a record-breaking $56 billion pay package for him.

The deal would’ve allowed Musk to buy a maximum of 304 shares for $23.34, on the condition that he met certain performance goals.

For context, Tesla now shares trade at a rate of $403 each.

Despite the majority of shareholders approving the pay deal, one investor filed a suit which claimed that the board had been misleading and that the pay package was unfair.

And the Supreme Court has since twice rejected Musk’s appeals, as Delaware Chancellor Kathaleen McCormick stated that Tesla’s ‘unprecedented theories go against multiple strains of settled law’.

The proposed pay package angered investors, so much so that one Dutch company got rid of all $585 million worth of its shares in the electric vehicle company.

Stichting Pensioenfonds ABP – one of Europe’s largest pension funds – sold its entire 2.8 million shares in September, valued at the time at $585 million, according to Bloomberg.

In a statement to the NL Times, an ABP spokesperson said ‘we cannot and do not need to invest in everything,’ adding that Musk’s pay deal was ‘by no means the only reason’ for the divestment.

ABP’s Tesla investment was only worth around a tenth of its other US company holdings, Fortune reported.

The publication claims ABP ‘owned €5.6 billion’ in technology company Nvidia at the end of September.

Meanwhile, its investments in Microsoft and Apple were even larger at €6.0 billion and €6.3 billion respectively.

Months after ABP sold its shares, Tesla stock skyrocketed to a record high of $479.86 in mid-December, following Donald Trump’s election in early November.

ABP told press that the move was not ‘politically motivated.’

Musk has been a prominent supporter of President-elect Trump, and has since been confirmed as the head of the new Department of Government Efficiency (DOGE).

While it isn’t technically a government department, it’s reported that DOGE will act as an outside advisor to Trump’s administration.

Under the new role, Musk has already promised to slash the federal budget by trillions.

Speaking about the appointment, Trump said DOGE will help his team to ‘dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures and restructure federal agencies’.

Musk has also attempting to influence politics across the pond in the UK, calling on King Charles to dissolve parliament and reportedly suggesting he’d donate $100 million to far-right, anti-immigration party Reform.

UNILAD has contacted Tesla for comment.